Max 403 Contribution 2024

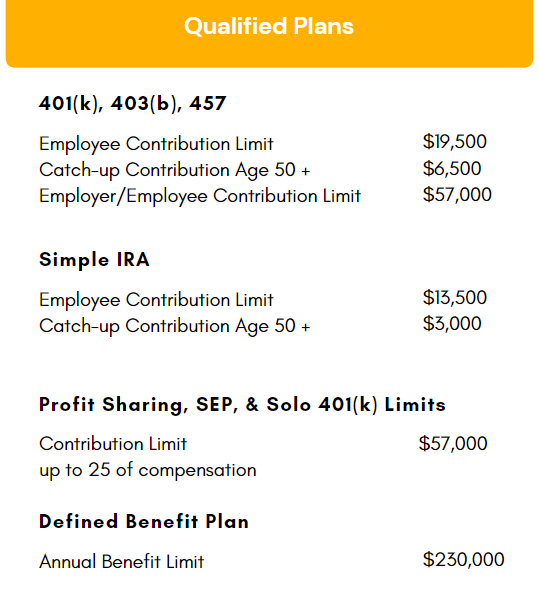

Max 403 Contribution 2024. This is the total amount that you can contribute to your 403(b) plan from your salary before taxes. For 2023, the 403(b) max contribution limit is $22,500 for pretax and roth ira contributions.

Discretionary or matching contributions from employers are permitted, up to a total combined maximum of $69,000 in employer and employee contributions for those younger than 50 in 2024 ($76,500. The 403(b) max contribution is fairly flexible, making it easy to reach your retirement goals.

Max 403 Contribution 2024 Images References :

Source: katavbernadette.pages.dev

Source: katavbernadette.pages.dev

Max 403 Contribution 2024 Calculator Freddi Alexina, The irs increased 2024 contribution limits for 401 (k)s, 403 (b)s, and iras.

Source: katavbernadette.pages.dev

Source: katavbernadette.pages.dev

Max 403 Contribution 2024 Calculator Freddi Alexina, Even if you only save a small percentage of your income to start, be.

Source: erichabregine.pages.dev

Source: erichabregine.pages.dev

What Is The Max 403b Contribution For 2024 Tax Year Dotty Gillian, If you have a 403 (b), you are subject to the 403 (b) contribution limits like any other retirement plan.

Source: katavbernadette.pages.dev

Source: katavbernadette.pages.dev

Max 403 Contribution 2024 Calculator Freddi Alexina, The maximum amount an employee can contribute to a 403(b) retirement plan for 2024 is $23,000, up $500 from 2023.

Source: katavbernadette.pages.dev

Source: katavbernadette.pages.dev

Max 403 Contribution 2024 Calculator Freddi Alexina, Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation.

Source: www.pensiondeductions.com

Source: www.pensiondeductions.com

Optimize Your Retirement Max 403(b) Contributions 2024 Tips, The amount of salary deferrals you can contribute to retirement plans is your individual limit each calendar year no matter how many plans you're in.

Source: alexisqjacquelin.pages.dev

Source: alexisqjacquelin.pages.dev

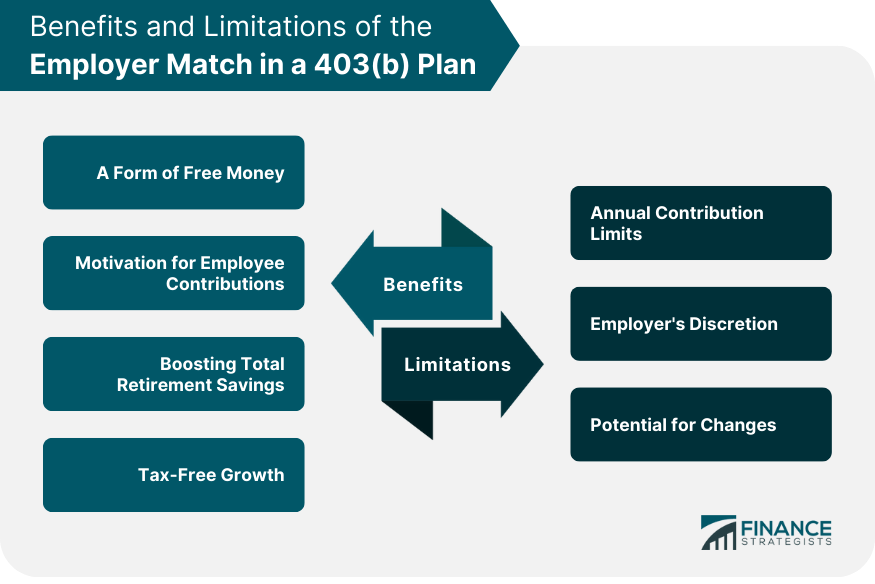

403 B Max Contribution 2024 Employer Match Dasie Emmalyn, Of note, the 2024 pretax limit that applies to elective deferrals to irc section 401(k), 403(b) and 457(b) plans increased from $22,500 to $23,000.

Source: laurenewrory.pages.dev

Source: laurenewrory.pages.dev

Maximum 403b Contribution 2024 Sonia Eleonora, The irs has announced the 2024 contribution limits for retirement savings accounts, including contribution limits for 401(k), 403(b), and 457(b) plans, as well as income limits.

Source: franniymyrtle.pages.dev

Source: franniymyrtle.pages.dev

2024 Max 403b Contribution Limits In Tally Elayne, Starting in 2024, employees can contribute up to $23,000 into their 401 (k), 403 (b), most 457 plans or the thrift savings plan for federal employees, the irs announced nov.

Source: claretatiania.pages.dev

Source: claretatiania.pages.dev

403 B Max Contribution 2024 Over 65 Chere Deeanne, The total contribution limit for both employee and employer contributions to 403 (b) plans under section 415 (c) (1) (a) increased from $66,000 to $69,000 ($76,500 if age 50 or.

Posted in 2024