Home Office Tax Deduction 2024

Home Office Tax Deduction 2024. Home office expenses for employees. You can use the home office.

Deductions reduce the amount of. Can you deduct your home office in 2024?

This Deduction Is Claimed On Your Personal Income Tax Return.

For 2024, it’s important to review the new rules on independent contractor tax deductions, the threshold for deductions based on the business.

Deductions For Expenses You Incur To Work From Home Such As Stationery, Energy And Office Equipment.

Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • february 4, 2024 5:57 pm.

Home Office Deduction At A Glance.

Images References :

Source: periaqmeghan.pages.dev

Source: periaqmeghan.pages.dev

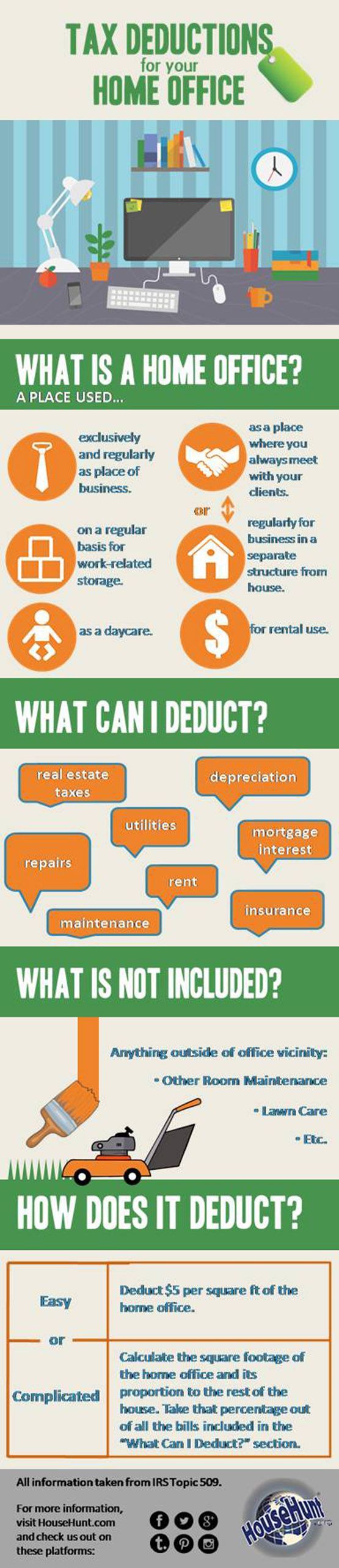

Home Office Deduction 2024 Federica, Home office deduction at a glance. Deductions for expenses you incur to work from home such as stationery, energy and office equipment.

Source: ronniqkaterina.pages.dev

Source: ronniqkaterina.pages.dev

Home Office Tax Deduction 2024 Cornie Kerrie, Offers an easier way to calculate the deduction,. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • february 4, 2024 5:57 pm.

Source: davida.davivienda.com

Source: davida.davivienda.com

Home Office Deduction Worksheet Excel Printable Word Searches, Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Home office deduction at a glance.

![Can I Take the Home Office Deduction? [Free Quiz]](https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/635c647797c263283309177a_Home Office Guide (5).png) Source: www.keepertax.com

Source: www.keepertax.com

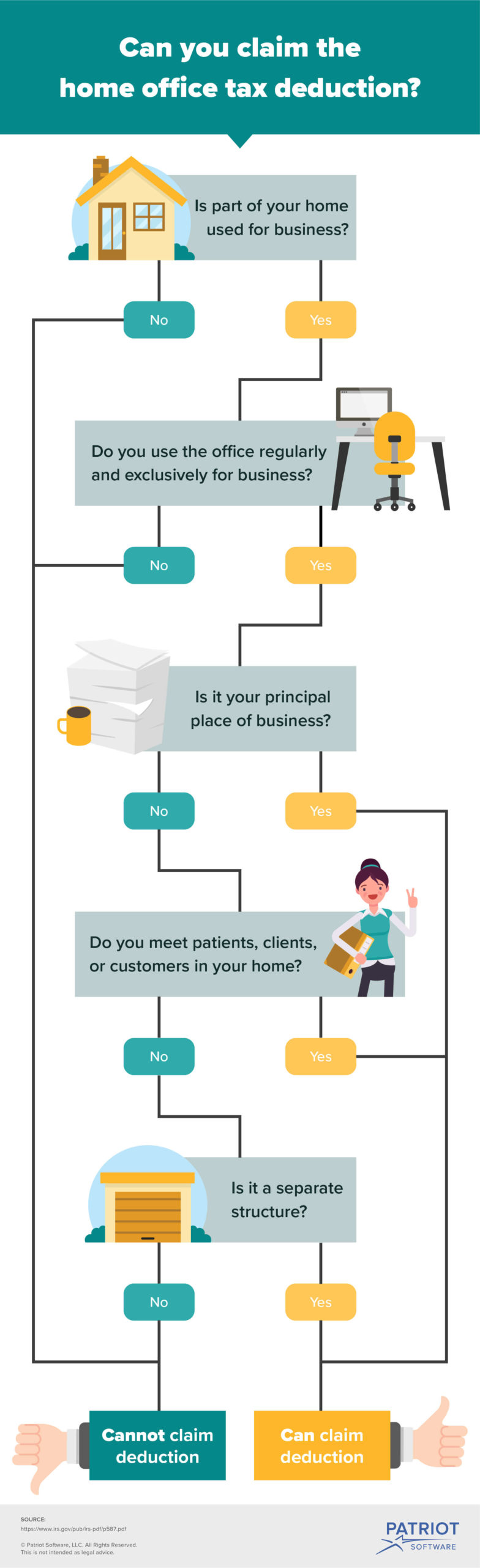

Can I Take the Home Office Deduction? [Free Quiz], The home office deduction provides a tax break for taxpayers who use a part of their home for business. Deductions reduce the amount of.

Source: www.nuventurecpa.com

Source: www.nuventurecpa.com

How to Claim the Home Office Tax Deduction as a FullTime RVer or, For 2024, it’s important to review the new rules on independent contractor tax deductions, the threshold for deductions based on the business. The home office tax deduction allows qualifying taxpayers to deduct certain expenses related to their home office on their tax return.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Home Office Tax Deduction What Is it, and How Can it Help You?, Offers an easier way to calculate the deduction,. The home office deduction lets you deduct a portion of your home expenses to reduce your business taxes owed.

Source: www.detroitnews.com

Source: www.detroitnews.com

Homeoffice tax deduction? Not so fast, For tax year 2021, the most recent year for which complete figures are available, the total value of the home office business deductions was just over. Can you deduct your home office in 2024?

Source: mileiq.com

Source: mileiq.com

The HMRC Home Office Tax Deduction Rules, Dec 13, 2022 5 min. Home office expenses for employees.

Source: akaunting.com

Source: akaunting.com

Home Office Tax Deduction 2023 Blog Akaunting, Deductions for expenses you incur to work from home such as stationery, energy and office equipment. If you have an exclusive home office space that you use for the full year, you can deduct $5 per square.

Source: www.balboacapital.com

Source: www.balboacapital.com

Home Office Tax Deduction Guide Balboa Capital, If you have an exclusive home office space that you use for the full year, you can deduct $5 per square. Standard deduction of $5 per square foot of home used for business (maximum 300 square feet).

Deductions Reduce The Amount Of.

For tax year 2021, the most recent year for which complete figures are available, the total value of the home office business deductions was just over.

This Deduction Is Claimed On Your Personal Income Tax Return.

Standard deduction of $5 per square foot of home used for business (maximum 300 square feet).