Cash Gift Limits 2024 In India

Cash Gift Limits 2024 In India. For savings accounts, individuals depositing. The irs recently announced that the annual gift tax exclusion for tax year 2024 will increase to $18,000 for individuals and $36,000 for married couples filing.

› as per the government rules, any gift in form of cash, cheque, land, building or property is taxable in the hand of. What is the exemption limit for cash gifts that.

However, If Any Gift Received From A Person Other Than A Relative Exceeds The Value Of Rs.50,000 In A Year, Then The Entire Amount Received As A Gift Is Taxable.

Monetary gift or money received in the form of cash, cheque,.

Learn About Gifting A Property, Gift Tax Rates, Exemptions, And The Tax Implications On Monetary Gifts.

Check gift tax in india & exemption limit.

Cash Gift Limits 2024 In India Images References :

Source: biddieqvioletta.pages.dev

Source: biddieqvioletta.pages.dev

2024 Gift Tax Limits Peggi Tomasine, Under current tax laws, not all gifts received in india are subject to tax. Learn about rules and exemptions.

Source: lonnaqnellie.pages.dev

Source: lonnaqnellie.pages.dev

Gift Limit 2024 Per Person Kally Marinna, The irs recently announced that the annual gift tax exclusion for tax year 2024 will increase to $18,000 for individuals and $36,000 for married couples filing. These gifts can be in any form,.

Source: ceceliawabbie.pages.dev

Source: ceceliawabbie.pages.dev

How Much Money Can You Gift Tax Free 2024 Rana Kalindi, The 2024 gift tax limit is $18,000, up from $17,000 in 2023. Any person cannot receive more than rs.2 lakh as cash gift in india from a person in a day in a single transaction as per the tax law.

Source: karilqmagdalena.pages.dev

Source: karilqmagdalena.pages.dev

Gift Money Limit 2024 Desiri Carmine, The indian legislative system sought to levy tax on gifts in the hands of. Knowing the annual gift tax exclusion can save you money and spare you from filing gift.

Source: www.indiafilings.com

Source: www.indiafilings.com

Cash Transaction Limit Section 269ST Tax Act IndiaFilings, I want to give a cash gift of more than ₹ 50,000 to my daughter at her wedding. Knowing the annual gift tax exclusion can save you money and spare you from filing gift.

Source: savingsfunda.blogspot.com

Source: savingsfunda.blogspot.com

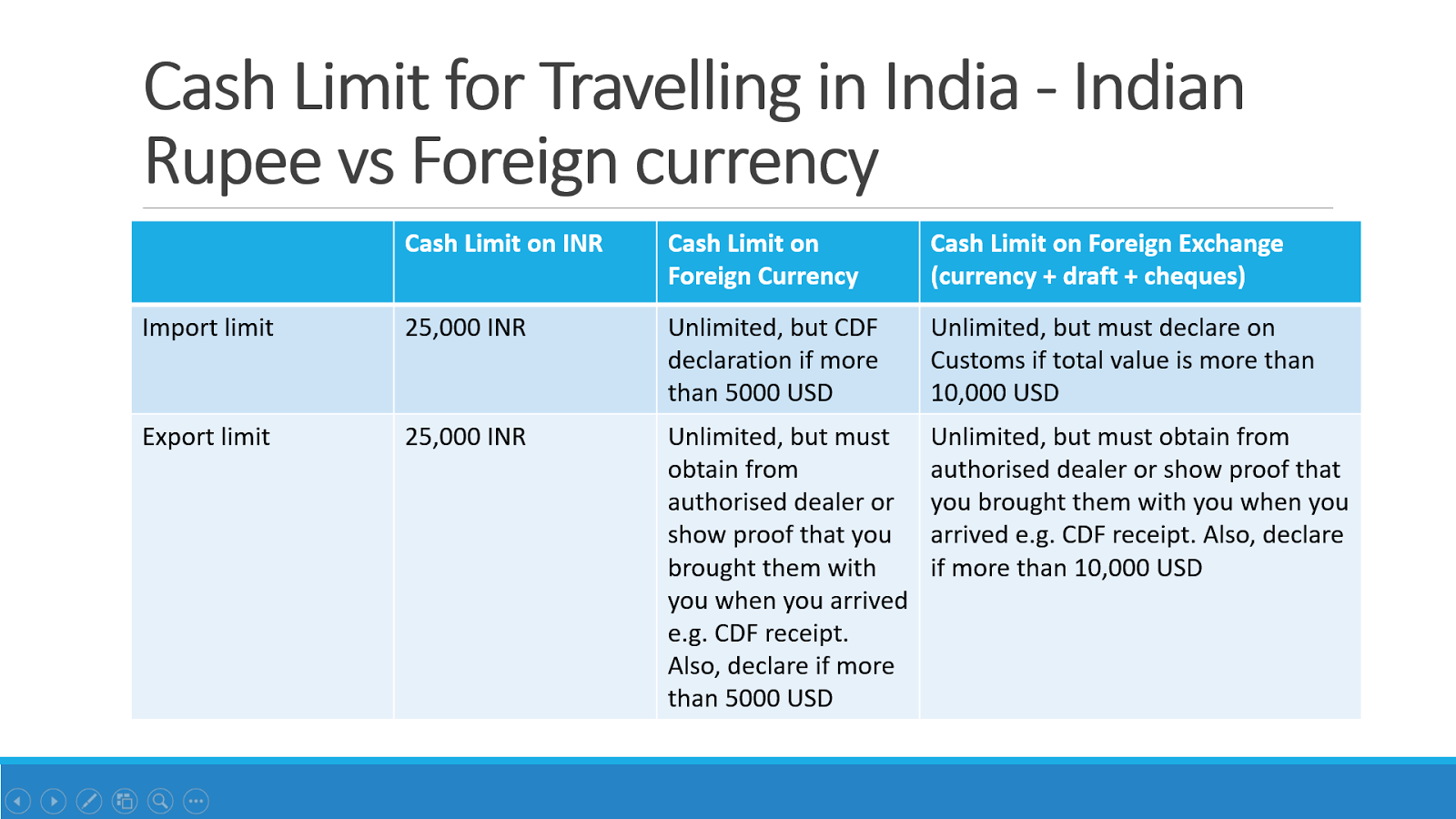

Indian Customs Limits for Carrying Cash to/from India Indian Rupee vs, Gifts received are tax free as per the specified limits but if any income is generated from it, the same is taxable as per the respective heads of the act. You may also be giving a gift if you offer someone.

Source: ramonawevey.pages.dev

Source: ramonawevey.pages.dev

Tsp Catch Up Contribution Limits 2024 Susi Zilvia, What is the limit of a cash gift? The indian income tax regulations set specific limits for cash transactions to monitor and regulate financial activities.

Source: wylmaqelisabetta.pages.dev

Source: wylmaqelisabetta.pages.dev

Gift Limit Tax 2024 Evonne Thekla, Is there any limit specified by the income tax department for keeping cash at home or one can keep as much cash as one wants? A taxable gift could include cash, but it could also include anything else of value, such as real estate, stocks, jewelry and more.

Source: deannaqleanora.pages.dev

Source: deannaqleanora.pages.dev

2024 Hsa Catch Up Contribution Limits Tana Zorine, You may also be giving a gift if you offer someone. According to the income taxact, money or movable/immovable property that an individual receives from another individual/organization without making a payment is termed as “gift”.

Source: hindiadvice.com

Source: hindiadvice.com

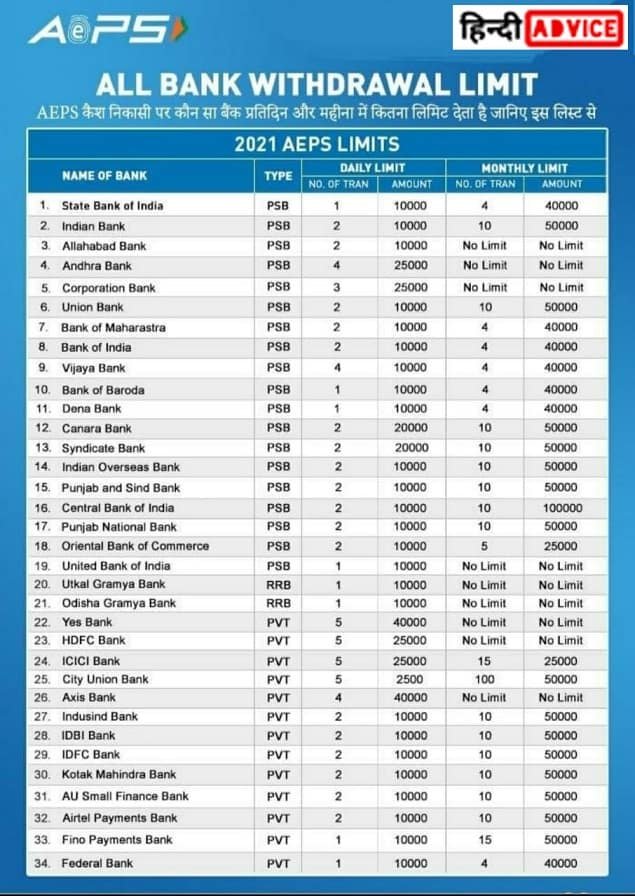

All Bank Aeps Withdrawal Transaction limit Pdf Chart 2024, Are you considering giving cash or property to loved ones or others in 2024? › as per the government rules, any gift in form of cash, cheque, land, building or property is taxable in the hand of.

According To The Income Taxact, Money Or Movable/Immovable Property That An Individual Receives From Another Individual/Organization Without Making A Payment Is Termed As “Gift”.

Learn about rules and exemptions.

Any Person Cannot Receive More Than Rs.2 Lakh As Cash Gift In India From A Person In A Day In A Single Transaction As Per The Tax Law.

Is there any limit specified by the income tax department for keeping cash at home or one can keep as much cash as one wants?

Category: 2024